UPDATE 1/11/24: How a House Becomes a CHT Home (meet homeowner Kelly!)

Our “How a House Becomes a CHT Home” blog series began in March of 2023, and it has tracked the story of how an idea and some drawings become a building and how that building takes shape as a house. This final installment of the series is the story of how that house becomes a home.

“The cherry on top of everything was the house,” says Kelly of her brand new home in Bridgepoint. She can’t help tearing up talking about what it’s taken for her to get to this point: “After everything I’ve been through, not giving up every time I got knocked down, I just kept getting up and it all came together.”

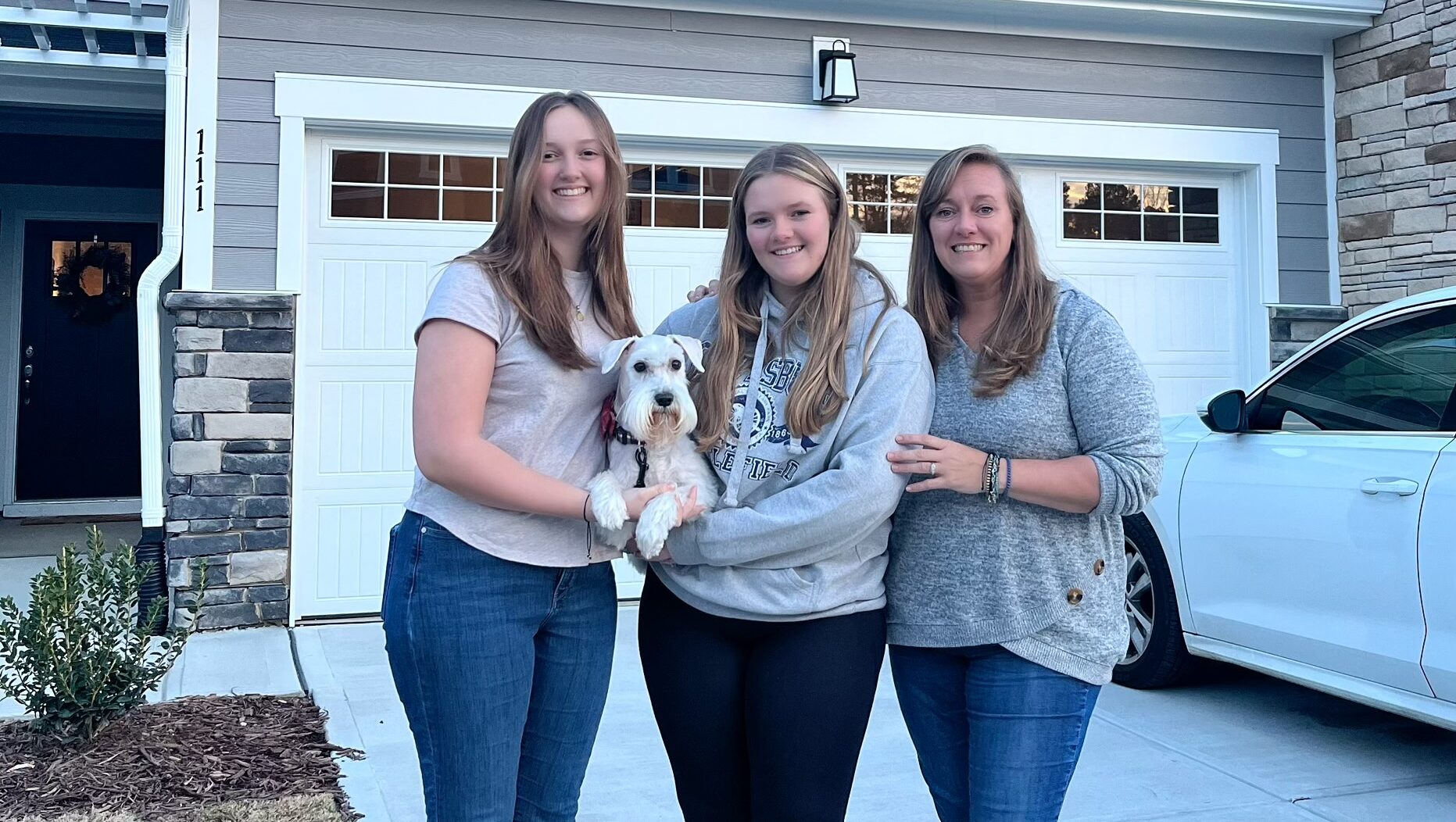

Kelly, her two teenage daughters, and their dog Walter moved into their townhome in Chapel Hill’s brand new Bridgepoint neighborhood just two months ago. Kelly’s road to homeownership was long and had many detours, starting with packing up and leaving a bad marriage with her two young daughters in tow 13 years ago. She landed in Whitsett while working in an inner city school in Greensboro; she eventually got a new job at Phillips Middle School in Chapel Hill, but her commute was long and tuition for her girls was expensive. When she went looking for homeownership programs for single moms and learned about CHT, she found that her ex-husband’s past foreclosure was a barrier to getting a loan, but she was determined to move to a better situation anyhow. So five years ago, she packed up again and moved into a rental home in Carrboro, where she set herself a five-year goal to own her own home.

Over the past five years, there were two other CHT homes Kelly almost purchased, but each time, it didn’t work out. She says it was an emotional rollercoaster, and her mom kept asking her why she was putting herself through the process just to be let down every time. But she says she had faith it would happen eventually, and she knows now that this home was the one that was meant for her and her family. Because five years almost to the day from setting her homeownership goal, Kelly and her family moved into their perfect home.

In fact, Kelly says that when she first saw pictures of the foundation of what would become her home at the start of construction, she rubbed her hand over the picture on the website and manifested that it would be hers. She drew a heart in the concrete on the construction site before she knew for sure that she’d be approved for her mortgage. And when she did finally walk into her brand new home on her closing day, she says she just rubbed her hand over the kitchen counter and sobbed.

“I have waited for so long!” she says. “At the end of the day, I was meant to have this home. All that heartache: no biggie!”

Kelly can’t express her gratitude enough for the support of the CHT team, which she says feels like family. “The women just embraced me,” including Amy Slaughter, CHT Sales Manager, and Teresa Parker, her lender with Union Home Mortgage. “And Ian, too!” CHT’s Property Manager, who walked with her through the process of getting to know her new home. She says she’s now “like a walking advertisement” for CHT, telling all her colleagues at school and even people she meets in Food Lion about her new home. “I just really believe in the program.”

As for advice for potential applicants, Kelly says they should prepare themselves for an emotional journey but should take a chance and give it a shot. “Even if you think you can’t, even if you think you wouldn’t qualify, it doesn’t hurt to try and see if you do, especially for single moms,” she explains. She also advises applicants to make sure they’re saving plenty of money for closing costs, which are significant. She thinks it’s especially important that CHT partners with applicants to help find them a home they can truly afford. “The home that you’re interested in may not be the just right home that you qualify for, but the Community Home Trust team will find the right home for you. They make sure that you’re not going to get yourself into trouble by taking on more than you can handle financially.”